Retention of Books of Accounts: Five Years or Ten Years?

Keeping the books of accounts (BOA) and other business documents is required for BIR tax audit purposes. Accountants and bookkeepers should ensure that all business transactions are recorded accurately in the books of accounts.

Aside from the books of accounts, you also need to maintain a file of your duplicate copies of the issued BIR-registered official receipts, original copies of official receipts from suppliers, duly acknowledged copies of income tax returns, and proof of tax payment.

Types of Books of Accounts

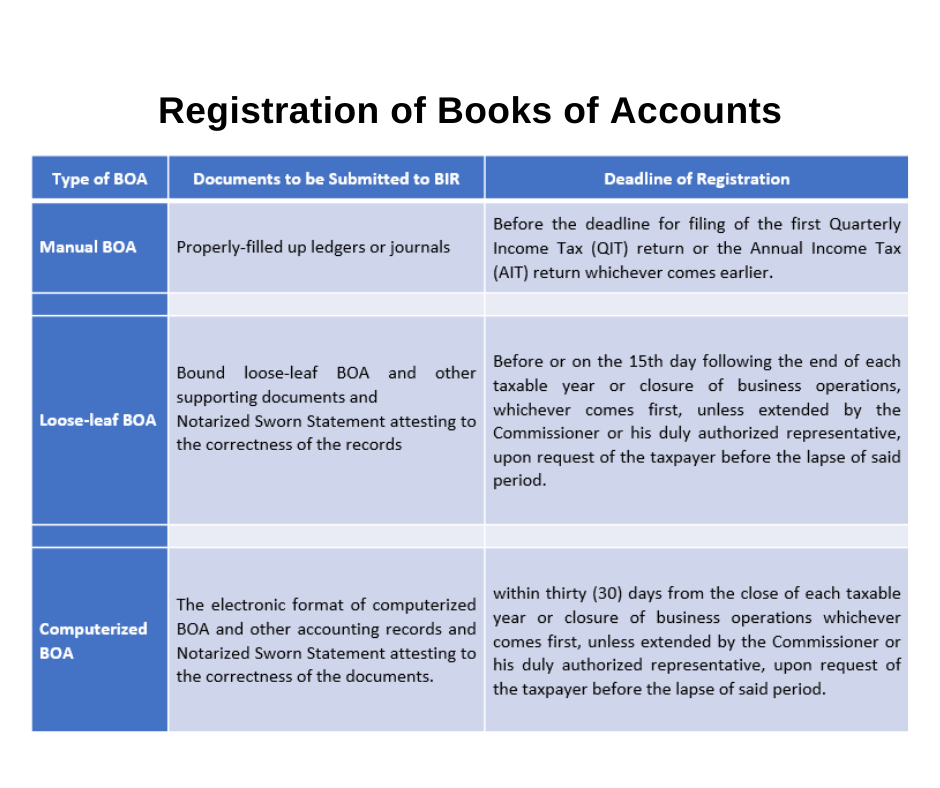

Taxpayers are required to register and maintain their books of account in any of the following forms:

- Manual BOA

- Loose-leaf BOA (requires Permit to Use)

- Computerized BOA (required Permit to Use)

Note:

- Taxpayers shall keep the BOA and other business records in the place of business at all times;

- The books and supporting papers should be kept intact, unaltered, and unmutilated.

- The entries in the manual BOA shall be handwritten. There should be no printouts of accounting records pasted or inserted onto pages of the journal or ledger;

- Businesses should maintain only one set of BOA and other records.

Examination of BOA

Businesses whose annual gross sales or earnings are more than Pesos: three million (P3,000,000) shall have their BOAs examined and audited by an Independent Certified Public Accountant (CPA).

Retention Period of BOA

Taxpayers are required to keep their business records for ten (10) years counted from the day after the deadline in filing the return, or in cases of late filing, from the filing date for the year, when the last entry was made in the books of accounts:

Provided that taxpayers shall retain hard copies of the business records within the first five (5) years from the day after the tax filing deadline. In cases of late filing, from the filing date for the year, when the last entry was made in the books of accounts.

After that, the taxpayer may retain only an electronic copy of the BOA, subsidiary ledgers, and other accounting documents in an electronic storage system prescribed in Section 2A of the Revenue Regulations No. 5-2014.

BIR Tax Audit

Accounting records are one of the most valuable documents in business. You can get a lot of information about your business by recording your transactions regularly and accurately in your journals and ledgers. That is why BIR continuously checks your accounting records to ascertain the correctness of your income and income tax paid.

You should not hate BIR audit, as most taxpayers do. All you need to have is an excellent working knowledge about taxation so that you can protect your rights as a taxpayer. If your books are in order and your taxes are fully accounted for, then the entire process is just a formality.

If you are still uneasy dealing with BIR examiners, we can help you ace the tax audit to avoid penalties. Our team has better exposure to tax compliance and in dealing with BIR personnel. Kindly send us a message at info@djkaaccounting.com

Recent Posts

- New Features and Functionalities of the Online Registration and Update System (ORUS)

- A Comprehensive Guide to Taxation for Freelancers in the Philippines

- New Tax Laws in 2024: What Changes Filipino Taxpayers Should Prepare For

- How to Avoid Common Tax Mistakes in 2024

- Tax Deductions and Benefits Often Overlooked by Filipino Taxpayers