BIR Listens: You have a Voice Through the Enhanced eComplaint System

Do you have issues or concerns with your BIR transactions? Do you want to complain against BIR officials or employees but are afraid they might take this feedback against you?

In today’s business environment, companies must listen to their customers. After all, they are the lifeblood of the business. Customers will not buy our products or get our services if their needs and wants are not satisfied.

The same is true when we are talking about government services. The public may not trust certain public agencies if their complaints and concerns are ignored. Thus, government offices may not maximize their full potential as a service entity.

We have seen many government agencies, like the Bureau of Internal Revenue (BIR), improving their services by hearing what the public wants.

Knowing the importance of taxpayers’ feedback in good governance, the country’s tax collector developed a complaint system to hear and address the taxpayers’ complaints.

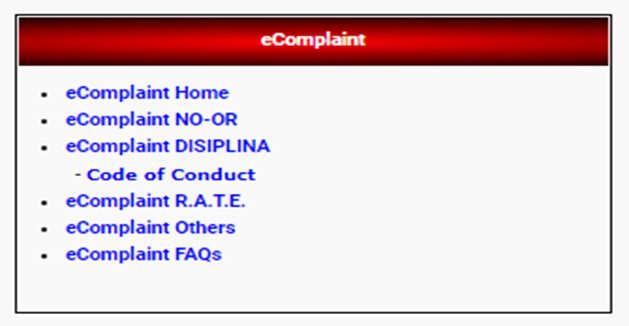

What is the BIR’s eComplaint System?

The eComplaint System is an electronic approach developed by BIR to allow taxpayers to report and express their complaints and concerns about BIR services and personnel.

The online platform was already in place since 2010. But the System needs re-engineering to maximize its utilization. Now, the enhanced System is simpler and more user-friendly.

What are the four types of BIR complaints?

1. Non-issuance of Official Receipt (NO-OR)

These are complaints related to the non-issuance of Official Receipt (OR) or Sales Invoice (SI) or the use of unregistered OR or SI.

2. Disiplina

Sometimes, we are not satisfied with the way BIR personnel handles our transactions. You now have an avenue to vent out your grievances against BIR officials or employees.

3. Run After Tax Evaders (RATE)

Be a BIR tax advocate by reporting individuals and entities not paying their taxes correctly or avoiding paying their taxes.

4. Other complaints

You may also express your satisfaction or dissatisfaction on BIR-related matters not classified above.

How to access the eComplaint System

1. Taxpayers access the BIR’s website and tap the” eServices” and “Other eServices”;

2. From the eComplaint Homepage, the complainant may select any one of the following menus:

3. Fill up the Complaint Form, including the complainant’s name and email address which are mandatory fields.

How does BIR handle the complaint?

1. The bureau acknowledges receipt of complaint through your email address within the day or the next working day if sent on a weekend or a holiday.

2. The Complaint Form goes directly to the concerned process owner for prompt action and response.

3. The bureau shall update the complainant on the action taken on the complaint within three days from assignment or referral to a Case Officer.

The new version of the eComplaint System promises a faster and accurate response to taxpayers’ concerns, which promotes client satisfaction.

When taxpayers are satisfied with BIR services, they tend to build a positive image of the bureau. And as in any business enterprise, when our clients are happy, it would mean additional business.

You may access the details of the memorandum order regarding the enhanced eComplaint system thru this link.

Recent Posts

- New Features and Functionalities of the Online Registration and Update System (ORUS)

- A Comprehensive Guide to Taxation for Freelancers in the Philippines

- New Tax Laws in 2024: What Changes Filipino Taxpayers Should Prepare For

- How to Avoid Common Tax Mistakes in 2024

- Tax Deductions and Benefits Often Overlooked by Filipino Taxpayers