Bookkeeping for Beginners

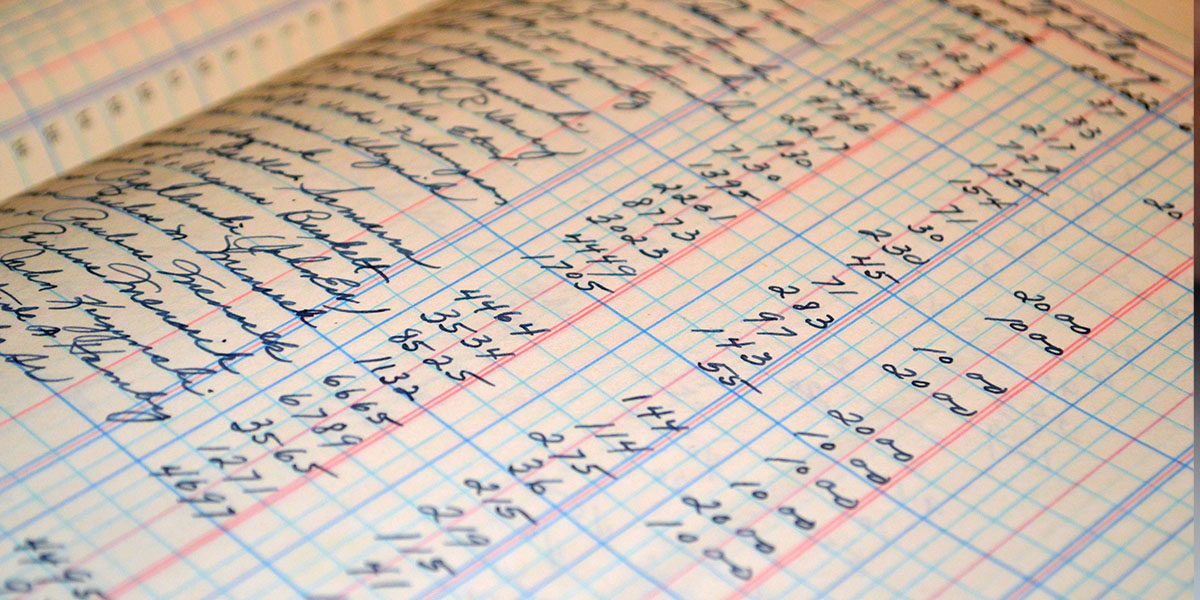

New business owners have to learn how to manage their cash flow from day one. This will be achieved through bookkeeping. Bookkeeping is the day-to-day recording of transactions, categorizing them and reconciling bank statements.

If you do not have the resources to hire someone to do this for you, you can learn to do it yourself. Here are some tips to get you started with bookkeeping.

- Open a bank account.

It is strongly advised that you open a separate bank account where you will put away the income you earn from your business. This will make it easier to keep track of your earnings and will make life so much easier during tax season.

- Track your expenses.

Learn to track your expenses effectively as this will help you monitor the growth of your business, build financial statements, keep track of deductible expenses, prepare tax returns and support what you report on your tax return.

Right from the beginning, you should establish a system for organizing receipts and other important records. You can manually keep the receipts or use an online program like ShoeBoxed to help you.

- Develop a bookkeeping system.

As a new business owner, you have to determine which bookkeeping method to use:

- You can choose to use software like Quickbooks or Wave or you could use a simple Excel spreadsheet.

- You can utilize the services of an outsourced or part time bookkeeper that is either local or cloud based.

- When your business is big enough, you can opt to hire an in-house bookkeeper and/or accountant.

- Set up a payroll system.

If you have employees, you need to decide on a payroll schedule and ensure that you are withholding the correct taxes. There are a lot of services that can help you with this.

- Investigate import tax.

If you have plans of purchasing and importing goods from other countries to sell in your store, you will be subject to taxes and duties. Determine how much of this will be passed on to your customer.

- Determine how you will get paid.

When sales start rolling in, you will need a way to accept payments. If you want to accept credit card payments, you will have to make arrangements with the banks to do so.

- Determine your tax obligations.

Tax obligations vary depending on the legal structure of the business. If you are self-employed, you will claim business income on your personal tax return. Corporations, on the other hand, are separate tax entities and are taxed independently from owners. Your income from the corporation is taxed as an employee.

- Calculate gross margins.

Improving your store’s gross margin is the first step towards earning more income overall. In order to calculate gross margin, you need to know the costs incurred to produce your product. Cost of Goods Sold (COGS) are direct costs incurred in producing products sold by a company and this includes both materials and direct labor costs. Gross margin represents the total sales revenue that’s kept after the business incurs all direct cost to produce the product or service. Gross margin is computed as revenue minus COGS divided by total revenue.

- Periodically re-evaluate your methods.

When starting out, you may opt to use a simple spreadsheet to manage your books but as you grow you will want to consider more advanced methods like Quickbooks or Bench. As you keep growing, it is good to continually reassess the amount of time you are spending on your books, and how much that time is costing your business. Finding the right bookkeeping solution means you can invest more time in the business.

Starting a business can be an overwhelming process, but if you follow this list you will have your new business’ finances in order from the beginning.

About the Author:

Anne Ruth Dela Cruz is a seasoned writer who has interests in health, wellness and business start ups. She has also dabbled in corporate communications and public relations. A mother of four, Anne also loves videoke sessions and reading a good book. My posts appear on: Negosentro, World Executives Digest, Executive Chronicles, Get Health Access, and Trade & Travel Journal.

Tags In

Recent Posts

- How to Process the Sworn Declaration Required by BIR for Electronic Marketplace Sellers

- Understanding Tax Compliance for e-Marketplace Businesses

- Who Needs to Submit GIS to the SEC?

- Understanding these Financial Ratios for Business Decision-Making Purposes

- What you Should Know about the Ease of Paying Taxes Act