An Overview of Accounting Software for Small Businesses

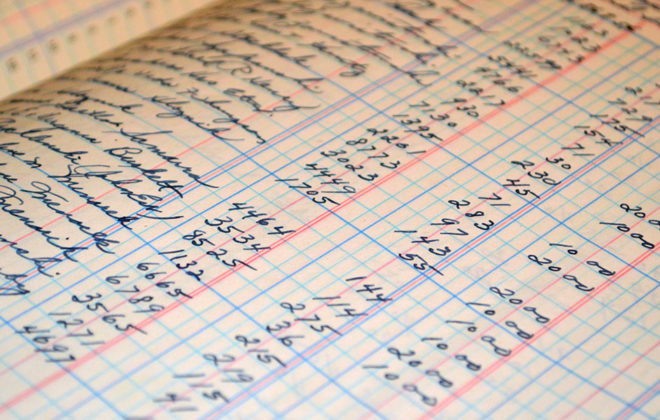

Accounting is the process of recording, summarizing, analysing, consulting, and reporting the financials of a company. It is the process of tracking all financial transactions to see the business expenditures, the sources of revenue, and which tax deductions the business owner will be able to…

Custom-Fit Accounting for Small Enterprises

Starting even a small business requires such an essential thing as accounting and bookkeeping service. From business registration to tax compliance and financial reporting, many tedious tasks are yet to be accomplished. It is better to outsource these services to an accounting firm to save…

Benefits in Benefiting Every Filipino Employee

Businessmen cannot be called a boss, an employer, or a leader without their employees. A win-win solution to treat their every Filipino employee well…

Accounting Tips for Small Businesses

It is essential for you to keep track of your revenues and expenses so that you know how your business is doing. Here are some accounting tips that can….

Bookkeeping for Beginners

New business owners have to learn how to manage their cash flow from day one. This will be achieved through bookkeeping. Bookkeeping is the day-to-day recording of transactions, categorizing them and reconciling bank statements. If you do not have the resources to hire someone to…

How an Annual Check-up can Fool-proof your Business

In order to ensure that we are in the pink of health, an annual visit to the doctor for a thorough check up is a must. The same imperative routine goes for your business. A regular check-up on the performance and status of your business…

Recent Posts

- New Features and Functionalities of the Online Registration and Update System (ORUS)

- A Comprehensive Guide to Taxation for Freelancers in the Philippines

- New Tax Laws in 2024: What Changes Filipino Taxpayers Should Prepare For

- How to Avoid Common Tax Mistakes in 2024

- Tax Deductions and Benefits Often Overlooked by Filipino Taxpayers